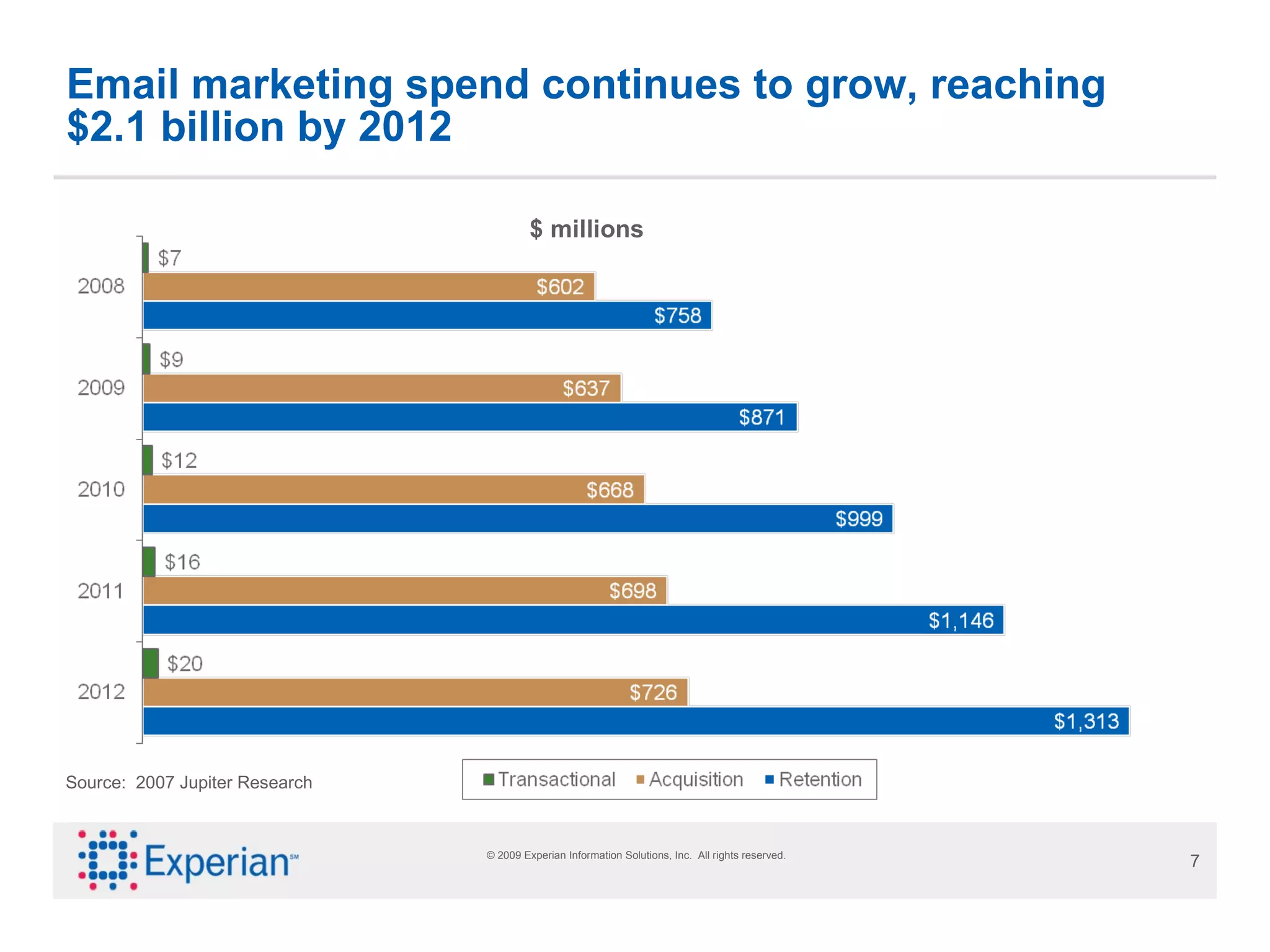

The document discusses the transition of offline marketing strategies to digital platforms, highlighting the significant growth in internet and mobile usage from 2007 to 2012. It emphasizes the importance of targeting and segmenting audiences across various digital channels, including email and mobile, while also noting the effectiveness of real-time marketing. Additionally, it covers the impact of data analytics on enhancing marketing strategies and the necessity for permission-based marketing in the digital age.

![Migrating offline marketing strategies into the digital world Jan Jindra 402-473-4865 [email_address] © 2009 Experian Information Solutions, Inc. All rights reserved.](https://image.slidesharecdn.com/migratingofflinemarketingstrategiesintothedigitalworldchicago-090602123531-phpapp01/75/Integrating-Offline-Marketing-Strategies-Into-the-Digital-World-Jan-Jindra-Senior-Product-Manager-Experian-Marketing-ServicesDiscover-the-new-ways-marketers-are-starting-to-leverage-consumer-data-and-successful-offline-strategies-for-online-marketing-1-2048.jpg)